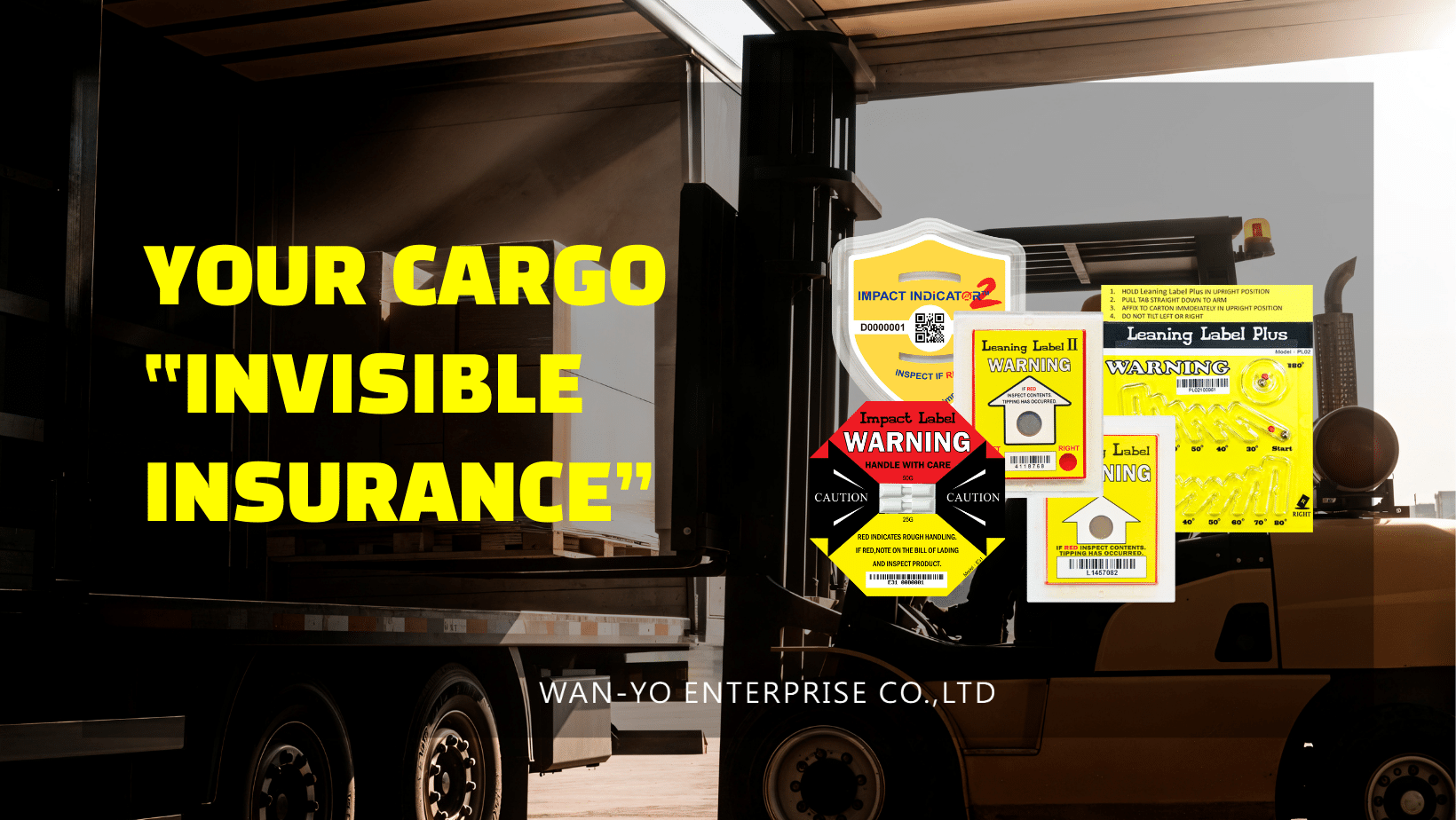

Insurance risk management, supply chain risk management tools, a well-structured cargo insurance policy, strict transportation compliance, and comprehensive cargo insurance coverage are no longer optional—they’re essential shields against costly claims, fraudulent insurance activities, and reputational damage.

The Unexpected Phone Call That Changed Everything

Picture this: You’re sipping your morning coffee when the phone rings. It’s your claims department. A high-value shipment—medical imaging equipment worth over $500,000—has arrived at the customer’s facility visibly damaged. The shipper swears it left their warehouse in perfect condition. The freight carrier blames “improper packaging.” The policyholder is angry and wants an immediate payout.

Your first thought as Risk Manager?

-

Is this legitimate?

-

Do we have clear evidence to determine liability?

-

Could this be an attempted fraud?

Now imagine if, attached to that shipment, there had been a Shock Indicator and a Tilt Indicator—both still showing “no mishandling.” Suddenly, you have powerful evidence that not only speeds up legitimate claims, but also filters out fraudulent ones before they reach litigation.

Why Insurance Risk Management Needs a Physical Evidence Layer

Most insurance risk management frameworks rely heavily on digital reporting, policy audits, and contractual checks. But without physical, tamper-evident proof, insurers can still fall victim to costly fraudulent claims.

From Risk Modeling to Risk Proof

Devices like Shock Indicators and Tilt Indicators record exactly how shipments were handled. If the devices remain untriggered while the claimant alleges damage, you’ve just saved your company from an unnecessary payout—and possibly uncovered fraud. That’s not just protection; it’s proactive defense.

How Supply Chain Risk Management Tools Reduce Claims Costs and Fraud

Modern supply chain risk management tools bridge the gap between theory and reality. While software platforms track shipment routes and conditions, physical indicators verify that reported handling actually happened—or didn’t happen.

Pallet Cushions – Prevention Before Proof

Pallet Cushions reduce the physical risk of damage, meaning fewer genuine claims in the first place. But when paired with indicators, they also strengthen fraud defenses: if damage is claimed but impact was absorbed without triggering the device, you have clear grounds to challenge suspicious cases.

Cargo Insurance Policy – Building Fraud Prevention into the Fine Print

A strong cargo insurance policy doesn’t just define coverage—it defines prevention requirements. By mandating or incentivizing the use of Shock and Tilt Indicators, you create a natural fraud deterrent.

Incentivizing Safer and More Honest Shipping

Fraudsters avoid environments where they know their claims will be challenged by hard evidence. Offering premium discounts for indicator-equipped shipments not only reduces claim volume—it makes your book of business inherently more trustworthy.

Transportation Compliance as a Compliance Officer’s Dream

For compliance teams, transportation compliance means enforcing contractual handling terms. Fraud prevention becomes a happy side effect—when conditions are documented by devices that can’t be “edited,” fraudulent handling claims collapse under scrutiny.

| Upgrade Your Risk Management Tools |

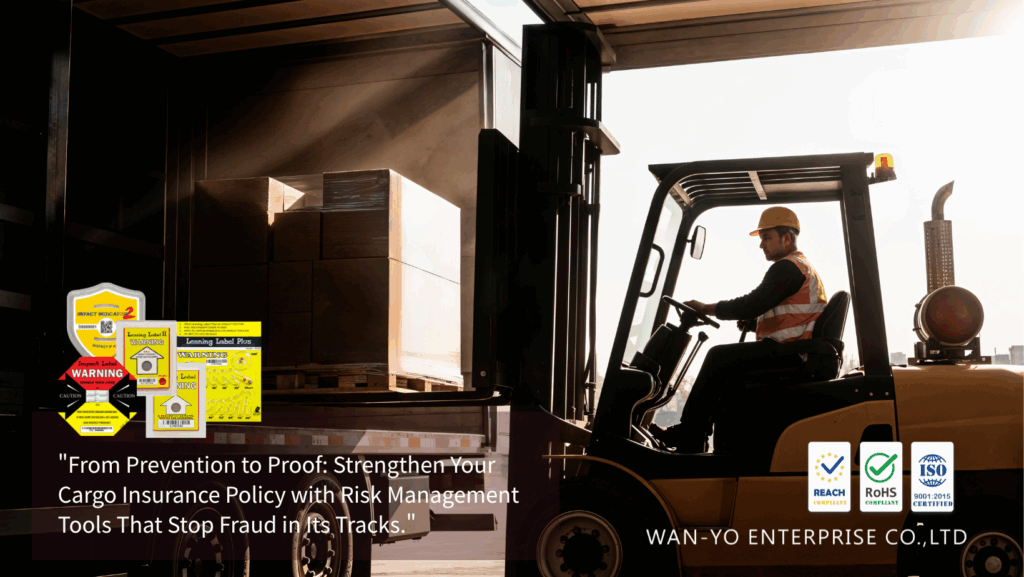

Cargo Insurance Coverage With Built-In Fraud Filters

Fraudulent claims erode profitability and trust. By integrating indicators into cargo insurance coverage, you filter out false claims before they snowball into costly disputes.

The “Quadruple Win” for Insurance Companies

By integrating these devices into your insurance risk management and supply chain risk management tools strategy, you gain:

-

Reduced claims costs – Fewer payouts for genuine damage.

-

Faster claims resolution – Hard evidence closes cases quickly.

-

Fraud deterrence – Clear, objective proof discourages false claims.

-

Stronger client relationships – Policyholders trust you as a proactive partner.

In a market where fraudulent claims can quietly drain millions from your loss reserves, the smartest insurers are embedding preventive technology into their cargo insurance policy and cargo insurance coverage strategies. Shock Indicators, Tilt Indicators, and Pallet Cushions don’t just prove mishandling—they also prove honesty. That’s good for your clients, your compliance team, and your bottom line.

“From Prevention to Proof: Strengthen Your Cargo Insurance Policy with Risk Management Tools That Stop Fraud in Its Tracks.”

| Reduce Claims & Fraud Today |

FAQ

1. What is insurance risk management in cargo shipping?

Insurance risk management in cargo shipping involves identifying, assessing, and mitigating potential risks that could lead to cargo loss or damage. It includes preventive measures like Shock Indicators, Tilt Indicators, and Pallet Cushions, which provide physical proof of mishandling, reduce claim disputes, and help prevent fraudulent claims.

2. How do supply chain risk management tools improve shipping safety?

Supply chain risk management tools, such as real-time tracking systems and physical handling indicators, monitor shipment conditions from origin to destination. They help detect rough handling, maintain transportation compliance, and provide evidence that can strengthen cargo insurance claims or dispute resolutions.

3. What should be included in a cargo insurance policy for high-value goods?

A cargo insurance policy for high-value goods should clearly define coverage scope, exclusions, claim procedures, and preventive requirements. Including conditions that mandate the use of handling indicators and protective packaging can lower risks and reduce both genuine and fraudulent claims.

4. Why is transportation compliance important for insurers?

Transportation compliance ensures that carriers follow agreed-upon handling standards, minimizing cargo damage and legal disputes. Insurers benefit because physical compliance verification tools, like Shock and Tilt Indicators, make it easier to enforce contractual obligations and prevent false claims.

5. What does cargo insurance coverage typically protect against?

Cargo insurance coverage typically protects against physical loss or damage to goods during transit, whether by sea, air, or land. Comprehensive coverage may also address risks like theft, rough handling, and improper stowage—especially when paired with monitoring devices that document shipping conditions.

6. How can indicators help prevent cargo insurance fraud?

Handling indicators act as tamper-proof evidence, recording whether cargo experienced shocks or tilts beyond acceptable limits. If damage is claimed but the indicators remain untriggered, insurers can challenge fraudulent claims with objective proof, saving both time and costs.

7. Are supply chain risk management tools worth the investment for insurers?

Yes. For insurers, these tools reduce loss frequency, improve claims accuracy, enhance client trust, and support transportation compliance. The long-term savings in reduced payouts and legal disputes often far outweigh the initial investment.